How does a decreasing life insurance policy work

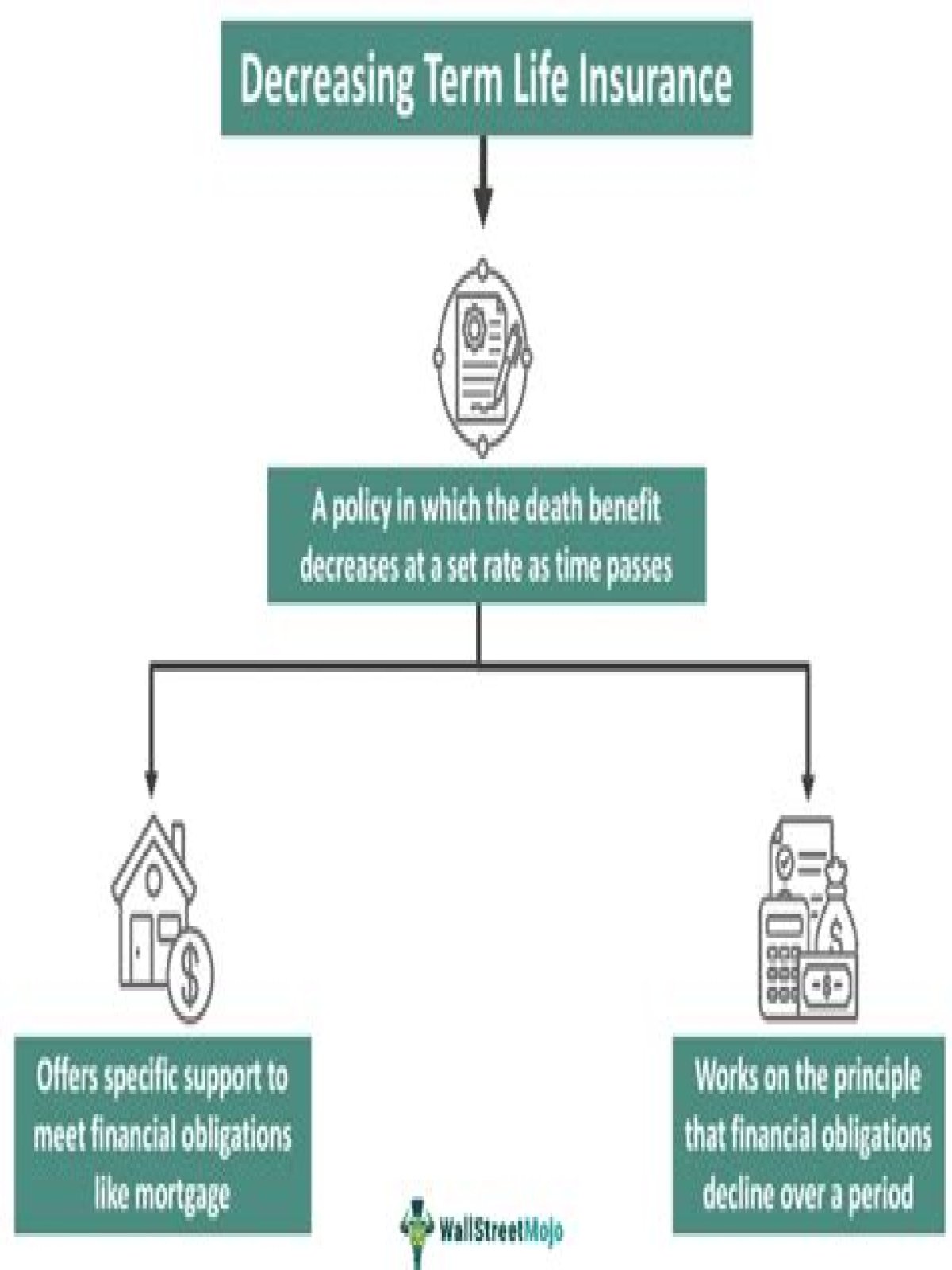

When taking out decreasing life insurance you will be covered for a fixed period or ‘term’. You pay premiums either monthly or yearly, and the total amount the policy will return decreases over that period. When you reach the end of your policy the pay-out will be zero.

- What happens at the end of a decreasing life insurance policy?

- What is true about a decreasing term life policy?

- What does decreasing whole life insurance mean?

- What is the difference between level and decreasing life insurance?

- Is it mandatory to have life insurance with a mortgage?

- What happens to my life insurance when I pay off my mortgage?

- What is 30 year decreasing term life insurance?

- When a decreasing term policy is purchased?

- What is one important element of decreasing term insurance?

- Why would a person choose decreasing term life insurance over level term?

- Can death benefits decrease?

- What is a decreasing cover?

- What is increasing and decreasing term life insurance?

- Does life insurance decrease with age?

- At what age should my house be paid off?

- Why you shouldn't pay off your house early?

- Do I need life insurance if I have death in service?

- How much does the average person spend on life insurance per month?

- Can you have more than 1 life insurance policy?

- What is decreasing term insurance plan?

- What type of individual would purchase decreasing term insurance?

- Can you reduce the amount of a term life insurance policy?

- What is decreasing term rider?

- Which type of life insurance policy generates immediate cash value?

- How is increasing term life insurance normally sold?

- Does life insurance provide liquidity at the time of death?

- What is minimum death benefit factor?

- What happens when the owner of a life insurance policy dies?

- Do beneficiaries pay taxes on life insurance policies?

What happens at the end of a decreasing life insurance policy?

When taking out decreasing life insurance you will be covered for a fixed period or ‘term’. You pay premiums either monthly or yearly, and the total amount the policy will return decreases over that period. When you reach the end of your policy the pay-out will be zero.

What is true about a decreasing term life policy?

However, a decreasing term life policy has a payout that lessens over time. Since the payout declines, decreasing term insurance often has lower rates than other types of term life insurance. When you buy a policy, you choose a coverage level and length. Term life plans typically come in lengths of 10 to 30 years.

What does decreasing whole life insurance mean?

Decreasing term insurance allows a pure death benefit with no cash accumulation, unlike, for example, a whole life insurance policy. As such, this insurance option has modest premiums for comparable benefit amounts to either a permanent or temporary life insurance.What is the difference between level and decreasing life insurance?

Simply put, with a level term life insurance policy, if you were to die within the term, your family will be paid the pre-agreed cash sum. For decreasing term, the cash sum reduces throughout the policy length, approximately in line with the decreases in a repayment mortgage.

Is it mandatory to have life insurance with a mortgage?

You’re not legally obliged to get life insurance for a mortgage, but some lenders may consider it a precondition for letting you borrow money to buy a home. For the vast majority of homeowners, having financial protection in place makes sense.

What happens to my life insurance when I pay off my mortgage?

This means the amount owed remains the same throughout the whole mortgage term and doesn’t decrease. At the end of the loan, you still need to pay off the original amount borrowed. With level-term insurance, the payout remains the same throughout the policy to reflect the unchanging mortgage balance.

What is 30 year decreasing term life insurance?

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy (typically 5 to 30 years). You pay the same amount each month or year, but your death benefit grows smaller.When a decreasing term policy is purchased?

Decreasing term policies are characterized by benefit amounts that decrease gradually over the term of protection and have level premiums. A 20-year $50,000 decreasing term policy, for instance, will pay a death benefit of $50,000 at the beginning of the policy term.

Which type of life insurance has a death benefit that decreases month by month?Term life insurance plans keep you covered financially for a set period of time. With a decreasing term life insurance policy, the death benefit for the plan decreases over time.

Article first time published onWhat is one important element of decreasing term insurance?

What is one important element of Decreasing Term Insurance? The premiums decrease over time.

Why would a person choose decreasing term life insurance over level term?

Benefits of decreasing-term insurance Because the payout amount falls over time, decreasing-term policies usually cost less than similar level-term coverage. Another benefit: You don’t need to pass a medical exam to buy the policy.

Can death benefits decrease?

While a level term life insurance policy has a face value that remains constant over the life of the policy, the death benefit decreases either monthly or annually for decreasing term insurance.

What is a decreasing cover?

Decreasing term life cover is designed to help your loved ones pay off your financial commitments such as a repayment mortgage, loans or credit card balances if you pass away during the term of the policy. The interest rate on your mortgage will also affect your insurance. …

What is increasing and decreasing term life insurance?

With an increasing term life insurance policy, every year, the death benefit from the plan is going to increase. A decreasing term insurance plan is the opposite, every year the coverage amount is going down. As the coverage amount changes, so does the monthly premiums.

Does life insurance decrease with age?

Your age is one of the primary factors influencing your life insurance premium rate, whether you’re seeking a term or permanent policy. Typically, the premium amount increases average about 8% to 10% for every year of age; it can be as low as 5% annually if your 40s, and as high as 12% annually if you’re over age 50.

At what age should my house be paid off?

“If you want to find financial freedom, you need to retire all debt — and yes that includes your mortgage,” the personal finance author and co-host of ABC’s “Shark Tank” tells CNBC Make It. You should aim to have everything paid off, from student loans to credit card debt, by age 45, O’Leary says.

Why you shouldn't pay off your house early?

If you have no emergency fund because you put your extra money toward an early mortgage payoff, a single financial disaster could force you to take out costly loans. Or, if your mortgage hasn’t been paid off in full yet, an emergency could lead to foreclosure on your house if it means can’t pay the mortgage later.

Do I need life insurance if I have death in service?

One of the main draws of death in service is that there’s no annual or monthly premium to pay – you just need to be employed to benefit from it. You’re required to make regular payments for life insurance, but, of course, your family or named beneficiaries could receive a higher payout in the event of your death.

How much does the average person spend on life insurance per month?

The average cost of a life insurance policy ranges from $40 to $55 per month. But, the true cost varies by the type of insurance, coverage amount, and personal factors.

Can you have more than 1 life insurance policy?

Yes, you can have more than one life insurance policy. There’s no law that prevents you from having a combination of different life insurance arrangements. But for most people’s circumstances, having one life insurance policy is usually enough.

What is decreasing term insurance plan?

A decreasing term insurance plan is a term plan where the Sum Assured decreases every year by a fixed percentage. … Premiums of decreasing term insurance plans are, usually, lower than premiums of a normal term insurance plan where the Sum Assured remains the same.

What type of individual would purchase decreasing term insurance?

Decreasing term insurance is ideal for individuals who wish to cover their financial obligations, debt, or loans. The instrument is ideal because it complements the size decrease of the debts and financial obligations over a fixed period of time.

Can you reduce the amount of a term life insurance policy?

For term life insurance and whole life insurance, the two most popular types of life insurance, you can generally elect to decrease your coverage amount at least one time during the life of the policy, which will reduce your premiums.

What is decreasing term rider?

The decreasing term riders all provide a declining amount of coverage over a specified period of time. Although the coverage is reduced over the period elected, the premiums remain level. … The coverage in a straight-line decreasing term rider declines at a uniform rate over the period of the rider.

Which type of life insurance policy generates immediate cash value?

Permanent life insurance is the most likely option to provide a cash value component. Types of permanent life insurances include: Whole life insurance. Universal life insurance (and subtypes including indexed and variable)

How is increasing term life insurance normally sold?

During the term of coverage, neither the death benefit nor the premium changes. How is increasing term life insurance normally sold? Insurers offer increasing term insurance as a “cost of living increase” rider on another policy.

Does life insurance provide liquidity at the time of death?

– Set up an estate plan. – Make estate and death tax payments. Life insurance is one the few ways to provide liquidity at the time of death. … If your death would cause financial stress for your spouse, children, parents, or anyone else you want to protect, you should consider purchasing life insurance.

What is minimum death benefit factor?

In general, the minimum death benefit is equal to the minimum death benefit factor for the age of the Insured multiplied by the policy value on the date of death of the Insured. … At the time a Policy is purchased, a policyholder can choose to include the Rider as part of his or her Policy.

What happens when the owner of a life insurance policy dies?

If the owner dies before the insured, the policy remains in force (because the life insured is still alive). If the policy had a contingent owner designation, the contingent owner becomes the new policy owner. … Without a contingent owner designation, the policy becomes an asset of the deceased owner‟s estate.

Do beneficiaries pay taxes on life insurance policies?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to report them. However, any interest you receive is taxable and you should report it as interest received.